Payroll Services – Managing payroll is an essential aspect of any business, and with Singapore’s stringent regulations, it’s crucial to choose a reliable payroll service provider. To simplify your decision-making process, we have curated a list of the 5 best payroll services in Singapore.

Top 5 Payroll Services In Singapore

In this comprehensive guide, we will present a summary, along with the pros and cons of each service, to help you find the perfect fit for your company’s needs and preferences.

1. PayrollServe

PayrollServe, a leading payroll service provider in Singapore, offers a comprehensive range of services tailored to businesses of all sizes. They provide payroll processing, leave management, tax calculations, and statutory submissions. Their cloud-based platform ensures secure access to payroll data anytime, anywhere.

Key Services

PayrollServe is a leading provider of payroll and HR outsourcing services. Some key services include:

- Payroll Processing: Provides comprehensive payroll services, including calculation of salaries, bonuses, taxes, and statutory contributions.

- Leave Management: Offers automated leave management systems for efficient tracking and management of employee leave.

- Time Attendance: Provides time attendance solutions to monitor employee attendance and streamline attendance records.

Achievements

PayrollServe has been recognized for its excellence in payroll services. They have received multiple awards for their innovative solutions and exceptional customer service.

- ISO 9001 Certification: PayrollServe is ISO 9001 certified, demonstrating their commitment to quality management systems.

- SaaS Awards Finalist: Recognized as a finalist in the Software-as-a-Service (SaaS) Awards for their payroll services.

Top Clients

PayrollServe serves a diverse range of clients across various industries. Some notable clients include:

- Small and Medium-sized Enterprises (SMEs).

- Multinational Corporations (MNCs).

- Government Agencies.

- Major Banks.

- Technology Companies.

- Retail Chains.

- Startups.

Pros And Cons

Here are the pros and cons of PayrollServe:

Pros:

- Robust and user-friendly online payroll platform.

- Efficient and accurate payroll processing, including timely tax calculations.

- Compliant with Singapore’s statutory requirements.

- Dedicated support team to address any payroll-related queries or concerns.

Cons:

- Pricing plans may be relatively higher compared to some competitors.

- Limited customization options for specific business requirements.

Contact

Contact Information for PayrollServe:

Address: 29 Tai Seng Avenue, #06-07 Natural Cool Lifestyle Hub, Singapore 534119.

Website: https://www.stoneforest.com.sg/payrollserve/.

Phone: +65 63025700.

2. Talenox

Talenox is a user-friendly payroll service provider that caters to small and medium-sized businesses. Their intuitive interface and automated features make payroll management a breeze. With Talenox, you can easily handle salary calculations, tax submissions, and CPF (Central Provident Fund) contributions.

Key Services

Talenox provides cloud-based HR and payroll software solutions. Their services include:

- HR Management: Offers a comprehensive suite of HR management tools, including employee onboarding, data management, performance tracking, and employee self-service portals.

- Payroll Processing: Provides seamless integration with various payroll systems, allowing efficient processing and management of payroll.

- Leave and Time Management: Offers automated leave and time tracking solutions to simplify and streamline HR processes.

Achievements

Talenox has received accolades for its user-friendly interface and advanced features. They have been recognized as a leading HR and payroll software provider in the market.

- Singapore HR Tech Market Leader: Recognized as the market leader in the Singapore HR tech market by G2, a leading software review platform.

- HR Vendors of the Year: Awarded “Best Payroll Software” and “Best HR Management System” by HRM Asia, a leading HR publication.

Top Clients

Talenox caters to businesses of all sizes, ranging from startups to large enterprises. Their client base includes companies from various industries such as:

- Finance.

- Technology.

- Healthcare.

- Manufacturing.

Pros And Cons

Here are the pros and cons of Talenox:

Pros:

- Intuitive and user-friendly interface, ideal for non-experts.

- Automated CPF calculations and tax submissions, reducing manual errors.

- Seamless integration with other HR systems.

- Affordable pricing plans suitable for small businesses.

Cons:

- Limited features for larger organizations with complex payroll needs.

- Additional charges for certain advanced features.

Contact

Contact Information for Talenox:

Address: 111 North Bridge Road, #27-01 Peninsula Plaza, Singapore 179098.

Website: https://www.talenox.com/.

Phone: +65 6336 0603.

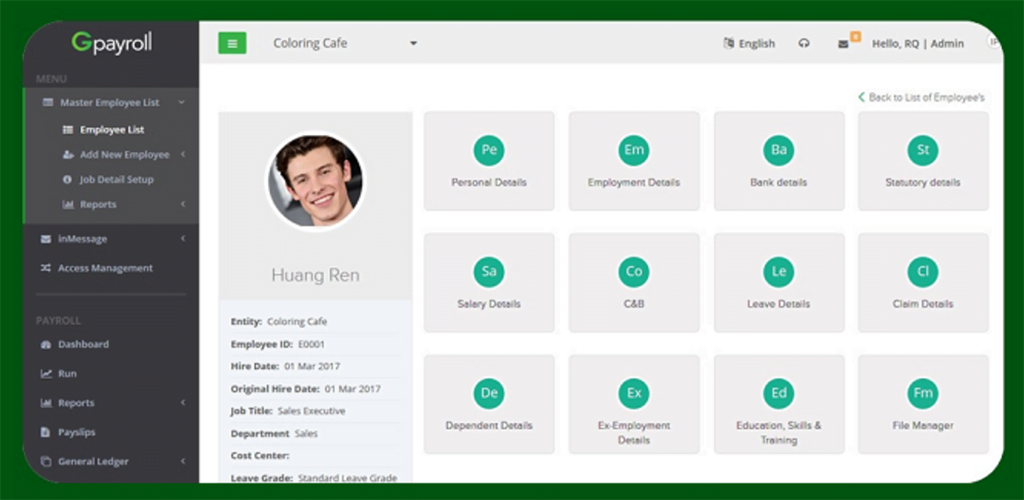

3. Gpayroll (Now known as ePayslip)

Gpayroll is a comprehensive payroll solution designed for businesses seeking flexibility and efficiency. With features such as salary calculations, employee self-service portals, and leave management, Gpayroll simplifies payroll administration. Their system is also equipped to handle complex overtime calculations and various payment methods.

Key Services

Gpayroll offers cloud-based payroll and HR solutions. Their services encompass:

- Cloud-based Payroll Software: Provides a user-friendly, cloud-based payroll software solution for businesses of all sizes.

- Employee Self-service: Allows employees to access their pay stubs, tax forms, and leave balances through a self-service portal.

- Statutory Compliance: Ensures compliance with local tax regulations and statutory requirements.

Achievements

Gpayroll is known for its streamlined payroll processes and automated features. They have received industry recognition for their user-friendly interface and efficient payroll services.

- HR Vendors of the Year: Awarded “Best Payroll Software” by HRM Asia, recognizing their excellence in payroll solutions.

Top Clients

Gpayroll serves clients across different sectors from small businesses to large enterprises, including:

- Retail.

- Hospitality.

- Accounting firms.

- Professional services firms.

- Non-profit organizations.

- Startups.

Pros And Cons

Here are the pros and cons of Gpayroll:

Pros:

- User-friendly interface with a customizable dashboard.

- Flexible and scalable payroll processing for businesses of all sizes.

- Advanced features for managing complex payroll requirements.

- Automated statutory contributions and reports.

Cons:

- Some users may find the initial setup process slightly time-consuming.

- Customer support response times may vary.

Contact

Contact Information for Gpayroll:

Address: 77 Robinson Road, #34-00 Robinson 77, Singapore 068896.

Website: https://www.gpayroll.com/.

Phone: +65 6591 8955.

4. Justlogin

Justlogin offers a comprehensive suite of HR solutions, including a reliable payroll service. Their payroll module ensures accurate and efficient payroll processing, leave management, and tax submissions. Justlogin’s cloud-based platform provides secure access to payroll data while maintaining compliance with Singapore’s regulatory framework.

Key Services

Justlogin provides cloud-based HR software and services. They offer solutions for:

- HRMS and Payroll: Offers a comprehensive HRMS platform with integrated payroll capabilities for end-to-end HR and payroll management.

- Employee Self-service: Provides employees with self-service portals for leave applications, claims management, and personal information updates.

- Expense Management: Streamlines expense management processes through automated expense claims and reimbursement workflows.

Achievements

Justlogin has been acknowledged for its comprehensive HR solutions and efficient workflow automation. They have received industry awards for their innovative products and customer satisfaction.

- HR Vendors of the Year: Awarded “Best Payroll Software” and “Best HR Management System” by HRM Asia, recognizing their expertise in HR and payroll solutions.

Top Clients

Justlogin caters to businesses of all sizes, from startups to multinational corporations. Their clients come from various industries, such as:

- Finance.

- Technology.

- Small and Medium-sized Enterprises (SMEs).

- Educational Institutions.

- Manufacturing Companies.

Pros And Cons

Here are the pros and cons of Justlogin:

Pros:

- All-in-one HR platform, integrating payroll, leave, and time management.

- Simplified tax calculations and statutory submissions

- Easy integration with other HR modules.

- Scalable solution suitable for businesses with diverse needs.

Cons:

- Some users may find the interface slightly complex initially.

- Limited customization options for specific business requirements.

Contact

Contact Information for Justlogin:

Address: 1 Changi Business Park Crescent, #02-01 Plaza 8 @ CBP, Singapore 486025.

Website: https://justlogin.com/.

Phone: +65 6221 0603.

5. Sage HR & Payroll

Sage HR & Payroll is a comprehensive solution that caters to the specific needs of Singaporean businesses. Their platform offers end-to-end payroll services, including CPF calculations, tax submissions, and leave management. Sage also provides detailed reports and analytics to help businesses gain valuable insights.

Key Services

Sage HR & Payroll offers integrated HR and payroll solutions. Their services include:

- HR Management: Offers an integrated HR management system that includes features like employee records management, performance appraisals, and training tracking.

- Payroll Processing: Provides payroll solutions for businesses of all sizes, ensuring accurate and timely payroll processing.

- Compliance Management: Helps businesses stay compliant with tax regulations, labor laws, and other statutory requirements.

Achievements

Sage HR & Payroll is recognized as a trusted provider of HR and payroll solutions. They have a strong reputation for their scalable software and reliable support services.

- HR Vendors of the Year: Awarded “Best Payroll Software” by HRM Asia, recognizing their excellence in payroll solutions.

Top Clients

Sage HR & Payroll serves a wide range of clients, including small businesses, mid-sized companies, and large enterprises. Their clients span multiple sectors, such as:

- Retail.

- Construction.

- Professional Services.

- Financial Institutions.

- Hospitality Industry.

Pros And Cons

Here are the pros and cons of Sage HR & Payroll:

Pros:

- Extensive range of payroll features tailored to the Singapore market.

- Flexible payroll calculations accommodating diverse employee types.

- Real-time analytics and reporting for better decision-making.

- Integration with other HR modules for streamlined processes.

Cons:

- Pricing plans may be relatively higher for smaller businesses.

- Some users may require additional training to fully utilize advanced features.

Contact

Contact Information for Sage HR & Payroll:

Address: 9 Battery Road, #17-02 MYP Centre, Singapore 049910.

Website: https://www.sage.com/en-sg/.

Phone: +65 6336 6118.

Conclusion

Choosing the right payroll services provider is vital for efficient and compliant payroll management in Singapore. Each of the five services mentioned above has its own strengths and weaknesses, catering to different business sizes and requirements. To summarize:

PayrollServe is a reliable choice for businesses of all sizes, offering a comprehensive range of services and a user-friendly platform. However, it may have higher pricing plans and limited customization options.

Talenox is ideal for small and medium-sized businesses, providing an intuitive interface and automated features. While it may lack advanced features for larger organizations, it offers affordable pricing plans.

Gpayroll offers flexibility and scalability, with advanced features to handle complex payroll requirements. However, the initial setup process may take some time, and customer support response times may vary.

Justlogin is an all-in-one HR platform with a reliable payroll module. While it may have a slightly complex interface, it provides simplified tax calculations and integration with other HR modules.

Sage HR & Payroll specializes in Singapore-specific payroll needs, with a wide range of features and real-time analytics. However, it may have higher pricing plans and require additional training for advanced features.

Consider your company’s size, budget, and specific requirements when selecting the best payroll service provider. It’s advisable to take advantage of free trials or demos to assess the user experience and functionality before making a decision.

Remember, payroll management is a critical aspect of your business, and choosing the right service will not only streamline your processes but also ensure compliance with Singapore’s regulations. Take the time to evaluate each option, weigh the pros and cons, and select the service that aligns best with your needs.

Investing in reliable payroll services will not only save you time and effort but also provide peace of mind, allowing you to focus on growing your business and taking care of your employees. Choose wisely and enjoy the benefits of seamless and accurate payroll management in Singapore!

1 thought on “5 Best Payroll Services In Singapore: Streamline Your Payroll Process!”

Comments are closed.